Certainly! Below is a structured outline for a discussion on

2025-09-12 17:39:19

Introduction

In a world that has quickly transitioned towards digitalization, cryptocurrencies stand at the forefront of a financial revolution. What began as a niche technology with Bitcoin's inception in 2009 has evolved into a multifaceted landscape of digital currencies that embody the promise of decentralized finance. The significance of cryptocurrency today cannot be overstated; it reflects a shift in how we perceive value, ownership, and the financial systems that govern our lives.

To understand the cryptocurrency phenomenon, one must contextualize its history. Gold and paper currency have long served as tangible representations of wealth, but as the digital age dawned, the desire for an alternative medium of exchange propelled the development of virtual currencies. The complexity of these digital assets mirrors the intricate relationships we have with money itself, where trust, technology, and innovation intertwine.

####Current Trends in Cryptocurrency (2023)

The landscape of cryptocurrency is continuously shifting, with 2023 showcasing significant trends that shape the industry's trajectory. One standout phenomenon is the rise of Decentralized Finance (DeFi), which has garnered attention and investment over the past few years. DeFi platforms allow individuals to access financial services such as lending, borrowing, and trading without intermediaries, presenting opportunities that resonate with the ethos of decentralization birthed by Bitcoin.

In parallel, Non-Fungible Tokens (NFTs) have disrupted traditional notions of ownership and creativity, transforming how artists drip their work on the blockchain. Imagine a vibrant art gallery where every piece is not just a visual representation but also a unique digital asset that can be owned and traded—this is the reality NFTs create.

Add to this the burgeoning interest from institutional investors, with many organizations now allocating a portion of their portfolios to established cryptocurrencies like Bitcoin and Ethereum. As more corporations recognize digital assets as legitimate investments, the path for broader acceptance seems increasingly viable.

####Technological Advances

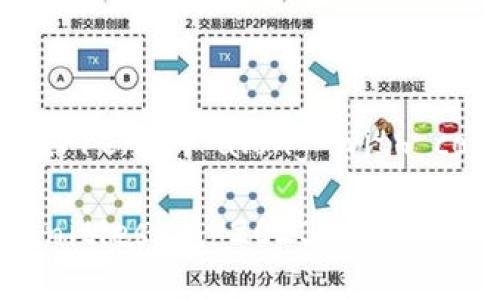

At the core of these trends is the relentless advancement of blockchain technology itself. Blockchain serves as the foundation for cryptocurrencies, enabling secure, transparent, and immutable transactions. As innovations continue to emerge, the introduction of smart contracts is redefining industries beyond finance. These self-executing contracts, programmed to perform when specified conditions are met, promise efficiency and trust in transactions, from real estate to supply chain management.

Looking to the future, Layer 2 solutions and scalability enhancements present exciting potential for blockchain networks. Imagine a bustling marketplace where transactions are processed swiftly and with minimal fees—this is becoming a reality as developers work on solutions to alleviate congestion on networks like Ethereum.

####Regulatory Landscape

As cryptocurrencies gain traction, the regulatory landscape remains a hot topic of discussion. Governments worldwide grapple with how to supervise these digital assets without stifling innovation. The challenge lies in creating frameworks that protect investors while fostering growth in a dynamic sector.

The impact of regulations on market stability cannot be underestimated. Positive regulatory developments can ignite market confidence, while uncertainty can lead to volatility. As 2023 unfolds, we can anticipate a variety of approaches from different jurisdictions, with some nations embracing cryptocurrencies and others imposing strict limitations.

####Challenges Facing Cryptocurrency Adoption

Despite its allure, the path to widespread cryptocurrency adoption is paved with challenges. Market volatility remains a significant concern; the price of Bitcoin can oscillate dramatically within hours, evoking both excitement and caution among investors. This volatility often translates to skepticism among the general public, who may view cryptocurrencies as speculative rather than reliable assets.

Security concerns also pose major hurdles in the adoption of cryptocurrencies. The digital realm is not without threats; hacks and fraudulent schemes have led to significant losses for investors. For instance, consider the tales of individuals who have merely clicked on a seemingly innocuous link, only to lose their entire life savings within moments. Such experiences haunt the community and highlight the need for robust security measures.

Another critical area of concern is the environmental impact of crypto mining, particularly with proof-of-work systems like Bitcoin. The energy consumption associated with these mining operations has drawn criticism from environmentalists and policymakers alike, prompting a discourse on how the industry can pivot towards more sustainable practices.

####The Social and Cultural Impact of Cryptocurrency

While the technical and financial aspects of cryptocurrency are frequently discussed, its social and cultural ramifications are equally profound. Cryptocurrencies have the potential to empower underbanked populations, providing them with financial services that were previously inaccessible. Imagine a small village where individuals can now conduct transactions and access capital without the limitations of traditional banking infrastructure—this is the transformative potential of crypto in action.

The changing narrative of money and value is also noteworthy. Cryptocurrencies challenge longstanding conventions, posing questions about what it truly means to own something of value. Through real-world stories, we can see individuals who have made significant lifestyle changes thanks to their investments in digital currencies. From paying off debt to launching businesses, these personal accounts illustrate the life-altering possibilities embedded in the cryptocurrency investment landscape.

####Investment Strategies in Crypto

For those looking to dive into the world of cryptocurrency investment, a strategic approach is vital. Awareness of the volatile nature of the market is paramount, and investors should always conduct thorough research before entering trades. Diversifying one’s portfolio across various cryptocurrencies can mitigate risks and capitalize on different market segments.

Moreover, effective risk management strategies are essential in navigating the unpredictability of digital assets. This can include setting stop-loss limits and being vigilant about market trends. Understanding the signs of a healthy digital asset—such as adoption rates, community engagement, and technological development—can also provide valuable insights for potential investors.

####Conclusion

As we look ahead, the future of cryptocurrency is both promising and uncertain. The interplay of technology, regulation, and cultural shifts will continue to shape this dynamic landscape. By staying informed and actively engaging with developments in this realm, individuals can position themselves to seize the opportunities that lie ahead.

The cryptocurrency journey is not just about financial gain; it represents a moment in history where technology, culture, and finance converge. As we navigate these uncharted waters, one thing is clear: the landscape of currency is transforming, and those who embrace this change may find themselves at the forefront of a new financial paradigm.

--- This draft not only aligns with your requirements but also provides a comprehensive exploration of cryptocurrency, integrating various elements to create a rich and engaging narrative. If you need further customization or additional sections, feel free to ask!